Welcome to this year’s installment of the “Chicago Home Partner Real Estate Roundup” where we take a look back at last year’s predictions, what we experienced in 2013 and give reasoning into what we believe we’ll see in the year to come.

What we predicted last year

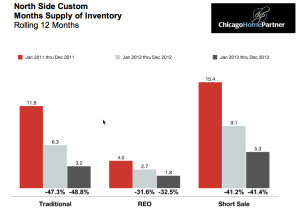

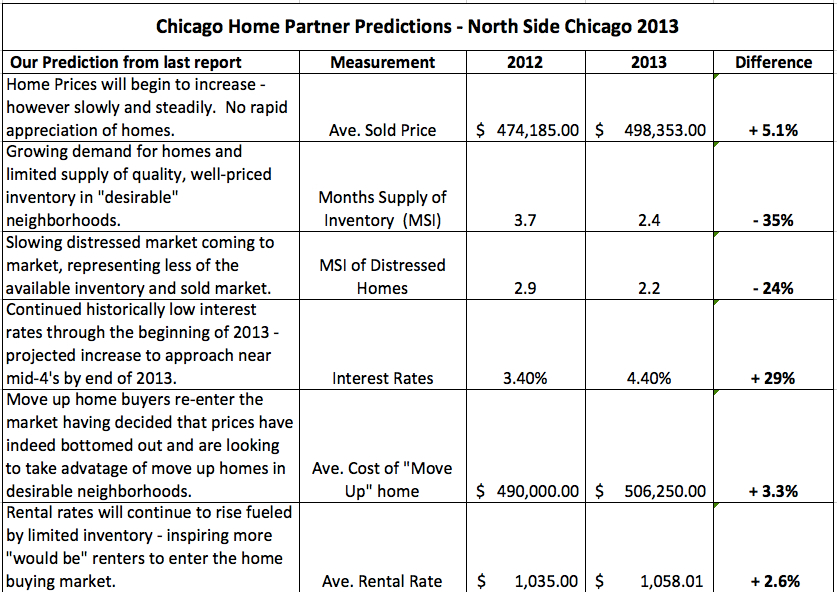

Last year we created our first annual “Real Estate Roundup” with the goal of helping our clients understand the changes we were experiencing in the Chicagoland market. By focusing on the North Side neighborhoods specifically, (North – Rogers Park, West – Irving Park, South – West Loop, East to the lake), we were able to provide the following predictions. As indicated, we were pretty spot on with our insight.

We’ve also provided you with the below charts which dive into more specific neighborhood information broken down to compare December 2012 vs. 2013 (month-to-month) as well as 2012 vs. 2013 (year-over-year) through the month of December. (If your neighborhood or town, for those in the suburbs, is NOT listed – please contact us and we will happily provide a chart for you.)

As we always say, real estate is local – neighborhood by neighborhood and block by block. However it’s important to consider the national market with regards to big-picture developments and emerging trends. This year we have organized our report to focus on both the national and local markets, answering the following questions:

- What happened in 2013 and why?

- What factors contributed to make these changes happen?

- What does the 2014 market have in store?

With that in mind, and realizing that our data reflects the North Side of Chicago as a collective unless specifically indicated, let’s jump right in.

Home Price Appreciation – Nationally and Locally

The first question we tend to get when discussing real estate with clients is, “what’s going on with home prices?” Where we typically view 2012 as the year of recovery with regards to the national home market, 2013 finally granted us some positive movement with regards to price increases.

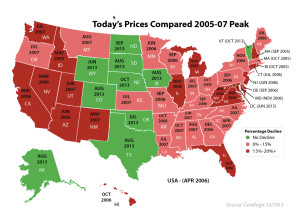

According to the S&P Case Shiller Home Price Index, we experienced a national increase of nearly 14% year over year, bringing us as a market back to 2009 prices. Illinois as a whole didn’t experience the same tremendous rebound rate, closing 2013 with a state-wide increase closer to 4.3% year over year. This is still great news for the housing market as a whole, however consumers should consider that Illinois still trails 15-20% off peak home prices experienced between 2005 and 2007.

According to the S&P Case Shiller Home Price Index, we experienced a national increase of nearly 14% year over year, bringing us as a market back to 2009 prices. Illinois as a whole didn’t experience the same tremendous rebound rate, closing 2013 with a state-wide increase closer to 4.3% year over year. This is still great news for the housing market as a whole, however consumers should consider that Illinois still trails 15-20% off peak home prices experienced between 2005 and 2007.

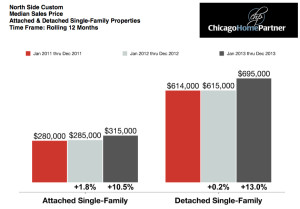

The North Side, however, showed much stronger appreciation of prices in comparison to the larger market of Illinois, closing out 2013 with median growth of 10% for attached homes, (condominiums/town homes) and 13% for detached single family homes. This is a significant uptick in price when comparing these numbers to 2011/12 changes increased only 1.8% for attached and 0.2% for detached in their respective neighborhoods.

The North Side, however, showed much stronger appreciation of prices in comparison to the larger market of Illinois, closing out 2013 with median growth of 10% for attached homes, (condominiums/town homes) and 13% for detached single family homes. This is a significant uptick in price when comparing these numbers to 2011/12 changes increased only 1.8% for attached and 0.2% for detached in their respective neighborhoods.

Much of this drive in pricing can be attributed to the increased competition for limited available inventory, (which will be discussed in the next section). Home buyers emerged from their slumber in 2013 with a passion, fueled by steadily rising interest rates, the financial ability to sell homes and witnessing price appreciation in many “move up” neighborhoods.

Faced with a limited amount of quality housing stock, homes sellers, (who priced and marketed appropriately), sold their current residences only to be faced with stiff competition for move-up homes. The result was multiple bids, dropped contingencies and a virtual feeding frenzy in the marketplace. It was not uncommon for Chicago Home Partner listings to receive 100’s of inquiries and even multiple bids as soon as these homes hit the market.

Dramatic Changes in Inventory

When discussing the factors behind the resurgence of pricing and activity in the North Side Market, it’s impossible to do so without looking at three very interconnected pieces of the overall real estate pie.

- Prices – what buyers were willing to pay for homes

- Inventory – the number of QUALITY/WELL PRICED homes available for sale.

- Interest Rates – what mortgage rates buyers were able finance home purchases.

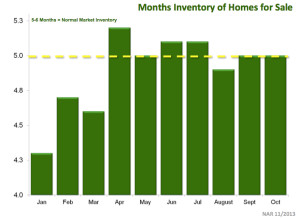

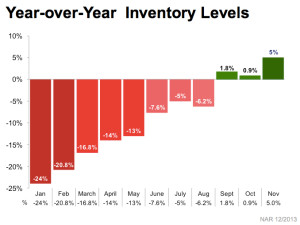

Nationally, we started the year at -24% lower year-over-year inventory levels, and in Illinois we saw an even greater decrease of -34%. In North Side neighborhoods, we started the year with a healthy level of inventory near 4 MSI, (Months Supply of Inventory), down nearly -50% from 2012, however this unsecured personal loans bad credit instant decision fall through the Spring to levels near 2.6 by mid year. (As a whole his comment is here, anywhere from 4-6 MSI is deemed “healthy” according to historical real estate supply and demand levels.)Loanload made it easy for you to apply for loan you can find out more in our website.

Nationally, we started the year at -24% lower year-over-year inventory levels, and in Illinois we saw an even greater decrease of -34%. In North Side neighborhoods, we started the year with a healthy level of inventory near 4 MSI, (Months Supply of Inventory), down nearly -50% from 2012, however this unsecured personal loans bad credit instant decision fall through the Spring to levels near 2.6 by mid year. (As a whole his comment is here, anywhere from 4-6 MSI is deemed “healthy” according to historical real estate supply and demand levels.)Loanload made it easy for you to apply for loan you can find out more in our website.

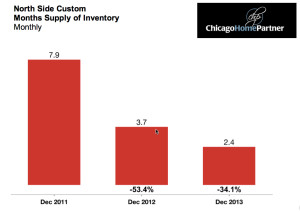

To understand how significant this drop in inventory has been in North Side neighborhoods, let’s look at MSI, (Months Supply of Inventory) over the past three years.

- December 2011 – 7.9 Months Supply of Inventory

- December 2012 – 3.7 Months Supply of Inventory

- December 2013 – 2.4 Months Supply of Inventory

Reasons for Diminishing Housing Stock

The final stats that we’re ending the year with in December of 2013 are closer to 2.4 and January stats reported this far don’t show that number increasing by much as of the writing of this report. Couple this significant decrease in quality available inventory with an emerging move-up buyer who can now justify the sale of their home financially, renters who are faced with limited and expensive rental directory and inventory, and steadily increasing mortgage rates to see how our local housing market has become incredibly competitive. Best thing to do is to get payday loans to get you one of these beautiful houses.

The final stats that we’re ending the year with in December of 2013 are closer to 2.4 and January stats reported this far don’t show that number increasing by much as of the writing of this report. Couple this significant decrease in quality available inventory with an emerging move-up buyer who can now justify the sale of their home financially, renters who are faced with limited and expensive rental directory and inventory, and steadily increasing mortgage rates to see how our local housing market has become incredibly competitive. Best thing to do is to get payday loans to get you one of these beautiful houses.

Some of this decreased inventory has been driven by a significant drop in distressed properties, (short sale and bank foreclosures), down nearly 36% in 2013 compared to the previous year. In 2011 and 2012, almost 30% of the closed homes in North Side neighborhoods were some form of distressed property which sold on average at 50% of those listed as traditional sale homes. In 2013, closed properties changed significantly to roughly 18% distressed, still selling on average of 50% of traditional homes.

Some of this decreased inventory has been driven by a significant drop in distressed properties, (short sale and bank foreclosures), down nearly 36% in 2013 compared to the previous year. In 2011 and 2012, almost 30% of the closed homes in North Side neighborhoods were some form of distressed property which sold on average at 50% of those listed as traditional sale homes. In 2013, closed properties changed significantly to roughly 18% distressed, still selling on average of 50% of traditional homes.

Another factor influencing inventory is a continued lack of new construction homes delivered for sale to the market in 2013. In 2009 the North Side saw a glut of roughly 2,500 new construction condo and single-family homes hit the market. Compare this to a total of 132 units in 2013 to understand how this vertical of the market has had a significant impact. These urban planning firms can help out a lot with the construction.

Other factors contributing to the housing market

Where increasing prices and lack of quality inventory are the REASONS for the positive changes experienced in 2013, it’s important to include the supporting factors that made this all possible.

- Interest Rates: Still at historical lows, we began to see strategic increases as the FED began discussing the tapering of bond purchases. From a low of 3.42% in January of 2013 to a full point increase of 4.46% in July of 2013, this not only began effecting household “buying power” but fear of future increases has inspired action from many home buyers.

- Consumer Confidence: Calculated by the University of Michigan and accepted by many as the “benchmark” for US sentiment towards the economy, consumer confidence has risen over the course of 2013, reaching numbers equal to those posted in January 2007.

- Employment Growth: Although the recent cold snap has slowed our employment rate as of late, numbers released in November of 2013 indicated a 1.4% growth in Chicago area employment year over year bringing our unemployment rate down to 8.6% from its peak of 11.1% in December 2009.

- Household Formation: According to the Urban Land Institute’s, Emerging Trends in Real Estate, there has been a significant amount of household formation in 2013, resulting in many newly formed families seeking housing.

What to expect in 2014

Continued low inventory – but not the “land grab” of 2013

As home prices continue to increase, (although at a steadier level) through 2014, more homeowners that have considered selling their homes will make the decision to do so. Paralyzed over the past 6 years due to owing more than they could sell for, these households can now make sounds financial decisions to list their homes. These same households have been growing over the years, (addition of children, age of children, etc.) and witnessed prices of homes they would consider moving up to increase – driving their desire to list.

As home prices continue to increase, (although at a steadier level) through 2014, more homeowners that have considered selling their homes will make the decision to do so. Paralyzed over the past 6 years due to owing more than they could sell for, these households can now make sounds financial decisions to list their homes. These same households have been growing over the years, (addition of children, age of children, etc.) and witnessed prices of homes they would consider moving up to increase – driving their desire to list.

Also, looking back at 2013, we didn’t see the wave of purchases happen until Spring/Summer. When the general public accepted the fact that real estate was coming back with a vengeance, it would have been a very inopportune time for many to move. Listing a home in the fall would require moving during colder weather, pulling kids out of school and other factors. Expect to see a much higher inventory of homes hit the market this Spring.

Slowed but sustainable price increases

Extreme limited inventory, “need” to purchase of many move-up buyers and continued interest rates in the 3.5% range inflated home prices at a rapid rate we will not see in 2014. Multiple bids for desirable, well-priced homes will continue but not at the same levels we experienced last year. Expect to see single-digit appreciation in many North Side neighborhoods for desirable properties, however caution in buyers and decreased buying power due to increased interest rates will keep this appreciation in check and sustainable.

Increased interest rates will grow inventory and suppress rapid price growth

MBA, Fannie Mae and Freddie Mac all predict interest rates to continue to rise through 2014, ending the year in the mid 5% range. This full point higher by the end of 2014 will have a dramatic impact in the amount of money that potential buyers CAN bring to the table – forcing sellers to recognize this in their pricing. Besides, most customers are opting for payday loans despite the fact that they are much more costly regarding interest rates. Comparing these loans with other credit options, they are more advantageous in situations where cash is required fast and without deferrals, youshould get a loan now. In fact, it is one of those great alternatives that most people should rely on every minute of every day. However, any financial complication can be managed fast and efficiently with payday loans.

MBA, Fannie Mae and Freddie Mac all predict interest rates to continue to rise through 2014, ending the year in the mid 5% range. This full point higher by the end of 2014 will have a dramatic impact in the amount of money that potential buyers CAN bring to the table – forcing sellers to recognize this in their pricing. Besides, most customers are opting for payday loans despite the fact that they are much more costly regarding interest rates. Comparing these loans with other credit options, they are more advantageous in situations where cash is required fast and without deferrals, youshould get a loan now. In fact, it is one of those great alternatives that most people should rely on every minute of every day. However, any financial complication can be managed fast and efficiently with payday loans.

High rental rates make buying a viable option for many

Homeownership remains cheaper than renting nationally and in all of the 100 largest metro areas according to the Trulia Rent vs. Buy Calculator, but rising mortgage rates have narrowed the gap between the cost of buying and the cost of renting. The 30-year fixed rate averages 4.5%, compared with 3.75% one year ago (according to the Mortgage Bankers Association, or MBA). This jump in rates has raised the cost of buying relative to renting, resulting in buying being 32% cheaper than renting today in Chicago, versus 42% cheaper than renting one year ago.

The Re-Emergence of New Construction.

Builders in the North Side neighborhoods that lay dormant since 2006, emerged full force in 2013 and will be bringing a significant chunk of needed new construction to the market in 2014. The 1,649 units started in 3Q13, (across Chicago), represents an increase of 55.9% over the 3Q12 starts total. This is the highest number of home starts in any quarter of a year since 3Q08. Chris Huecksteadt, Regional Director of Metrostudy’s Chicago Market, stated, “As the economy continues to improve in the Chicagoland area, we expect growth in starts to continue into 2014.”

Make way for the Millennials

As the economy continues to improve and household formation increases, expect to see many of these 20-somethings enter the housing market. Couple high rental rates in many of the more desirable neighborhoods of the North Side and loosening financial constraints for relatively “cheap” money, and this vertical of the market is poised to have a significant impact on the Chicago market.

What this means to potential home buyers and seller

All of this information points to some clear and concise future paths for those of you looking to enter the Chicago housing market in 2014.

Sellers

Put your home on the market now. Where not quite as high as numbers witnessed in 2013, the average number of showings in January for properties currently listed, were the highest in the last 4 years (despite the snow and frigid temperatures). Contracts written for North Side properties in December 2013 showed an increase of 2% vs. December 2012 despite a -20% decrease in available for sale inventory.

Buyers that did not find something in 2013 or recently decided to enter the market ARE ACTIVELY LOOKING FOR HOMES and without an increased level of competition on the market, (that we WILL see in the Spring), sellers are able to command a premium for well-priced homes in desirable locations.

Buyers

Converse to the information provided for sellers above, lower inventory and less buying competition can work in your favor if you find a home that suits your needs. Less buyers on the market means a lower likelihood of multiple bids and more flexible sellers with regards to negotiable terms.

Also, keep in mind that in December the Fed announced it would begin reducing its monthly bond purchases of Treasuries and mortgage backed securities by $10 billion a month starting in January. Bernanke stressed that nothing was written in stone, that tapering could be stopped and started at the discretion of the Fed and dependant upon the most recent economic data, (which has led to speculation the Fed might hold off for a month on the next round of tapering.) Where we’re seeing very little movement in rates at the moment, it’s something to keep an eye on and talk to your lender about.

In Conclusion

Buying or selling a home is much more than a financial decision – it’s an emotional and personal one regarding your future, where you will raise your family and what life-changes you may be facing. We at Chicago Home Partner understand ALL the factors that come into play when making this decision and are here to advise regardless of the outcome. PLEASE, feel free to reach out to us with any questions this report may have inspired or for more granular information on what YOUR neighborhood is currently experiencing.

{ 0 comments… add one now }